The Duty of Offshore Investment in Estate Planning and Wealth Preservation

The Duty of Offshore Investment in Estate Planning and Wealth Preservation

Blog Article

The Leading Reasons for Considering Offshore Financial investment in Today's Economic situation

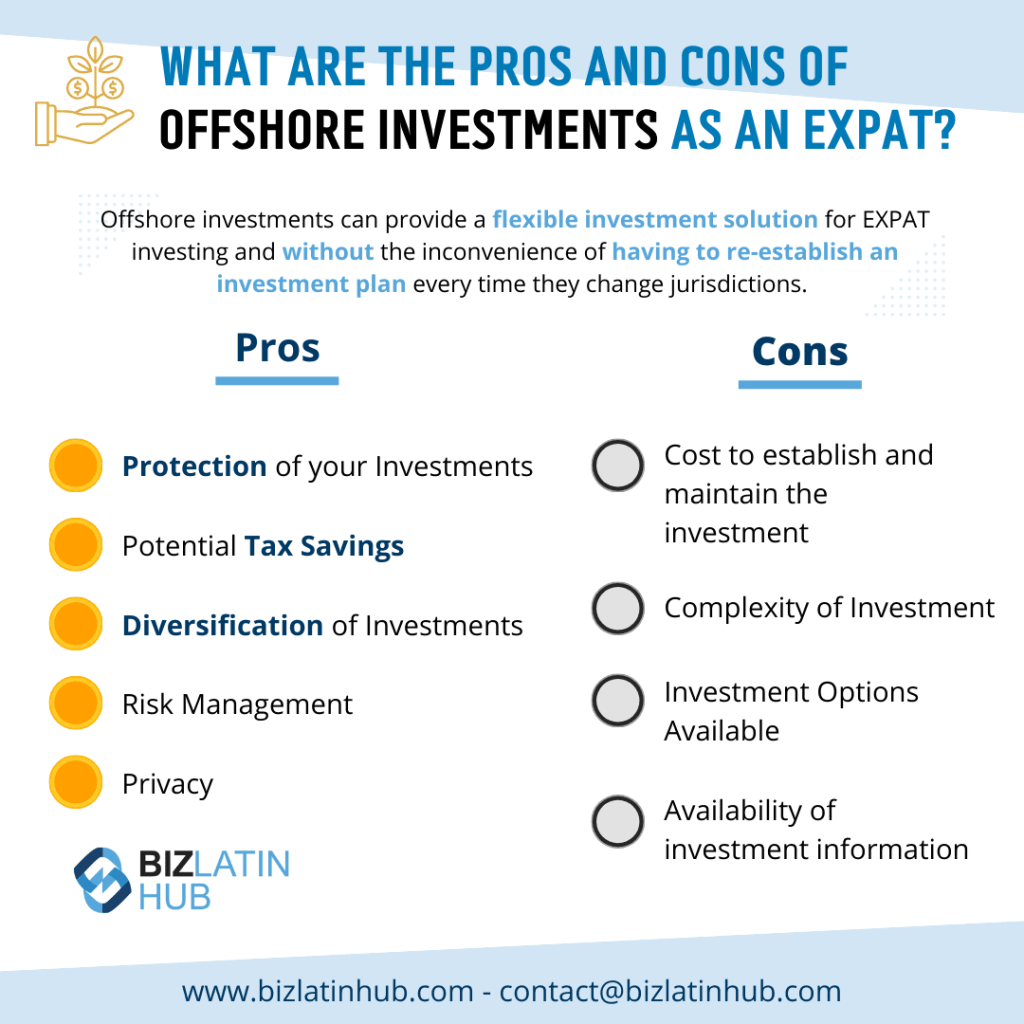

In the context of today's unstable financial landscape, the values of offshore financial investment warrant mindful factor to consider. What details advantages could offshore investments bring to your portfolio in the present environment?

Diversity of Financial Investment Portfolio

One of the primary reasons investors consider offshore investments is the opportunity for diversification of their investment portfolio. By designating properties throughout numerous geographical areas and markets, capitalists can mitigate risks connected with focused financial investments in their home nation. This method is particularly beneficial in a significantly interconnected international economic climate, where economic downturns can have localized effects.

Offshore financial investments enable people to tap right into emerging markets, industries, and money that may not come with domestic methods. As a result, financiers can potentially gain from one-of-a-kind growth opportunities and hedge versus volatility in their regional markets. Expanding right into international possessions can lower direct exposure to domestic economic fluctuations, rate of interest rate adjustments, and political instability.

Along with geographical diversification, offshore investments frequently incorporate a series of asset courses, such as stocks, bonds, genuine estate, and alternate investments. This complex strategy can boost risk-adjusted returns and provide a buffer versus market recessions. Inevitably, the mix of global direct exposure and differed asset courses placements capitalists to accomplish long-term financial goals while navigating the intricacies of international markets.

Tax Obligation Benefits and Savings

Offshore investments also use considerable tax obligation benefits and savings, making them an attractive option for financiers looking for to optimize their financial strategies. Many territories provide favorable tax obligation therapy, permitting investors to lower their overall tax obligation responsibilities. Specific offshore accounts may make it possible for tax deferral on capital gains until withdrawals are made, which can be advantageous for long-lasting investment growth.

Furthermore, offshore structures can assist in estate planning, making it possible for people to move wealth efficiently while minimizing inheritance taxes. By utilizing depends on or other lorries, financiers can safeguard their possessions from too much tax and ensure smoother changes for future generations.

Furthermore, some overseas territories enforce little to no revenue tax obligation, supplying opportunities for higher returns on financial investment. This can be especially helpful for high-net-worth individuals and companies seeking to maximize their capital.

Access to Global Markets

Furthermore, spending offshore offers a special possibility to invest in industries and fields that are prospering in various regions. Technical developments in Asia or eco-friendly energy initiatives in Europe can provide profitable financial investment options. This geographic diversification not just lowers dependency on domestic financial cycles yet likewise minimizes risks associated with localized declines.

Additionally, offshore financial investment systems often offer investors with a bigger variety of economic tools, including foreign stocks, bonds, mutual funds, and alternate properties. Such a variety makes it possible for Related Site investors to tailor their portfolios according to their danger tolerance and financial investment objectives, improving overall profile strength.

Boosted Financial Privacy

While keeping economic privacy can be challenging in today's interconnected globe, overseas investment approaches offer a substantial benefit hereof. Numerous financiers look for to protect their economic info from scrutiny, and offshore jurisdictions supply lawful frameworks that support confidentiality.

Offshore accounts and investment automobiles usually come with durable personal privacy laws that restrict the disclosure of account details. This is particularly advantageous for high-net-worth individuals and businesses aiming to guard sensitive monetary data from unwanted interest. Many territories also offer solid asset security actions, making sure that assets are shielded from prospective legal conflicts check my blog or lenders.

In addition, the complexities surrounding international banking policies commonly indicate that information shared in between jurisdictions is marginal, further boosting confidentiality. Investors can make use of various offshore frameworks, such as counts on or minimal partnerships, which can provide additional layers of personal privacy and security.

It is critical, nevertheless, for financiers to follow appropriate tax obligation regulations and laws in their home countries when utilizing offshore financial investments. By very carefully browsing these demands, individuals can enjoy the benefits of improved economic privacy while adhering to lawful responsibilities. Generally, offshore financial investment can function as an effective tool for those looking for discernment in their monetary events.

Defense Versus Economic Instability

Lots of capitalists acknowledge the relevance of protecting their properties versus economic instability, and offshore investments give a feasible service to this problem (Offshore Investment). As worldwide markets experience fluctuations due to political stress, rising cost of living, and uncertain financial policies, diversifying investments throughout boundaries can minimize risk and enhance profile strength

The diversification offered by overseas financial investments also allows access to useful content arising markets with growth potential, permitting critical positioning in economies much less affected by worldwide unpredictabilities. Because of this, investors can stabilize their profiles with possessions that might execute well throughout domestic financial downturns.

Conclusion

In verdict, the factor to consider of offshore financial investment in the contemporary economic situation presents countless benefits. Offshore investments supply critical security against economic instability, furnishing investors with tactical placing to properly navigate unpredictabilities.

One of the key reasons investors think about overseas financial investments is the opportunity for diversification of their investment profile.In addition to geographical diversification, overseas investments typically include a range of property classes, such as supplies, bonds, real estate, and alternative financial investments.Offshore financial investments additionally use considerable tax obligation advantages and financial savings, making them an eye-catching alternative for financiers looking for to optimize their economic methods.Accessibility to international markets is an engaging benefit of offshore investment approaches that can significantly boost a capitalist's profile.Offshore financial investment options, such as international actual estate, international mutual funds, and foreign money accounts, enable capitalists to secure their properties from regional economic recessions.

Report this page